Credit Facts

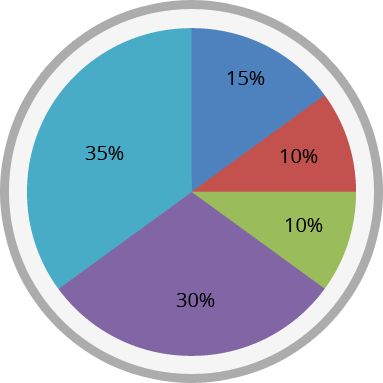

Credit Facts: Scores Determination Factors

- 10% types of credit in use

- 10% recent inquiries on your credit report

- 15% length of your credit history

- 30% outstanding debt

- 35% payment history

- Payment History

- Amounts Owed

- Length of Credit History

- New Credit

- Types of Credit Used

Credit Reporting Facts

Fact1

If you are worried about why your credit score is low, it’s important to know that a poor credit score will not haunt you forever. A score is a “snapshot” of your risk at a particular point in time. It changes as new information is added to your bank and credit bureau files. Scores change gradually as you change the way you handle credit. For example, past credit problems impact your score less as time passes.

Approximately 15% of a credit score may be based upon length of credit history. A credit score can be positively impacted the longer that accounts have been open, especially if they are with one financial institution.

Recent studies have shown 96.1% of all credit reports contain inaccurate credit info. That is 420 million credit files reporting wrong. This could be a factor in why your credit score is low.

46% of credit reports contain errors serious enough to cause a borrower to receive a higher interest rate and fees when borrowing.

Companies are making billions of dollars collectively on bad credit. 1 of 4 credit reports contain errors and consumers are paying the price in higher interest and lending fees

29% of credit reports contain errors serious enough to cause credit denial.

The fair credit reporting act amendments of 2006 were put in place to protect you the consumer. It’s your right to dispute erroneous credit information reporting on your credit report. Act now!

Credit scoring considers only credit-related information. Factors like gender, race, nationality and marital status are not included. In fact, the Equal Credit opportunity Act (ECOA) prohibits lenders from considering this type of information when issuing credit.

Approximately 35% of a credit score may be based upon payment history. A credit score is negatively impacted if bills are paid late or if there is a history of delinquent payments listed on the credit report, including matters of public record such as bankruptcy, collection accounts, etc.

Approximately 30% of a credit score may be based upon amounts owed or other outstanding debt. If the amount owed is close to the credit limit, that could be why your credit score is low. A low balance on two credit cards may be better than a high balance on one credit card.